Here’s a rapid but comprehensive look at the biggest AI stories of the week. In just a minute, you’ll get caught up on deals, product launches, open source innovations, and shifting power in the AI landscape.

Table of Contents

1. OpenAI & NVIDIA’s $100B Infrastructure Pact — Who’s Paying Whom?

What the deal says

OpenAI and NVIDIA have struck a landmark agreement for NVIDIA to invest up to $100 billion in OpenAI as they jointly build out at least 10 gigawatts of AI compute infrastructure via NVIDIA systems. The first gigawatt deployment is set for H2 2026 using NVIDIA’s Vera Rubin platform.

The idea: as OpenAI deploys each gigawatt of infrastructure, NVIDIA will incrementally invest.

The “money triangle” with Oracle

Your question about “who really paid” is astute. A media analysis frames this as a circular flow:

- OpenAI purchases compute and cloud services (reportedly including from Oracle)

- Oracle buys NVIDIA’s GPUs to deliver those services

- NVIDIA invests in OpenAI

In effect, some of the capital “comes back” into NVIDIA, making the loop more about aligning incentives and securing supply than pure altruism.

However, it’s not a simple round-trip. NVIDIA’s investments are conditional on infrastructure deployment. Also, regulatory, valuation, and timing terms still need final agreement.

Strategic and regulatory implications

This tight coupling raises antitrust concerns: if OpenAI prioritizes NVIDIA hardware exclusively, rivals could be squeezed. And questions remain about whether NVIDIA’s investments will target OpenAI’s nonprofit or for-profit entities.

From NVIDIA’s perspective, investing in its own customers helps enlarge the addressable AI infrastructure pie. Analysts argue that NVIDIA has so much capital that backing its ecosystem is more lucrative than traditional investments.

In short: money does flow in a circuit, but the deal is structured with conditions, risk management, and oversight, not a naive cycle.

2. Microsoft & Anthropic’s Warming Ties: Claude Enters Copilot

Why it matters

Microsoft is opening up Microsoft 365 Copilot to allow users to choose between OpenAI models and Anthropic’s Claude family. Claude Sonnet 4 and Claude Opus 4.1 models now appear as options in Copilot Studio and “Researcher” mode.

This is a major shift: Microsoft has long relied on GPT-based models for its Copilot experiences. The move signals a diversification of their AI stack and loosening exclusivity.

What changes for users

- You’ll see a “Try Claude” option in Researcher, letting you pick Claude instead of GPT for deep research tasks.

- In Copilot Studio, developers can pick which model powers each agent.

- Copilot still supports GPT models, but Anthropic is now a first-class citizen in Microsoft’s productivity AI foil.

The evolving relationship suggests Microsoft is hedging bets, preventing overreliance on one provider, and capitalizing on competition.

3. ChatGPT Gets Proactive: Your “Secret Agent” Assistant

No longer is AI just waiting to answer your queries. OpenAI has rolled out a personal assistant agent inside ChatGPT—one that works behind the scenes. It analyzes your calendar, emails, chat content, and preferences overnight. Then, in the morning, it sends you tailored cards: news, travel tips, daily schedule, reminders… the full concierge package.

This marks a pivot from reactive chat to proactive AI service—anticipating your needs rather than waiting for inputs. The model becomes integrated into your life, not just your queries.

4. Benchmark Battle: Claude Opus, GPT-5 & Accuracy Claims

OpenAI recently introduced a career competency benchmark in which Claude Opus claims top performance: in nearly half of the tasks, Opus outperformed senior human experts. Meanwhile, GPT-5 is being touted as offering even higher accuracy.

This escalation continues the arms race: not just beating previous models, but challenging humans. We should watch how real-world deployment and peer review validate these claims.

5. Alibaba’s “Qwen” Suite & Multimodal Push

China’s Alibaba introduced its Qwen family of models, often translated as “Thousand Questions”:

- Qwen 3: Trillion-parameter model integrated into Alibaba’s full stack “family bucket” of services.

- Qwen Omni: A multimodal system intended to rival Google’s Gemini.

- Qwen VL: A vision-language model that claims to beat closed-source alternatives in visual tasks.

At the Max Math Competition, Qwen models reportedly scored perfect marks. Alibaba positions this moment as the closest any domestic model has come to frontier status.

They’re casting Qwen as not only a domestic star but a global competitor to Gemini, GPT, and others.

6. DeepSeek & Open Source Advances

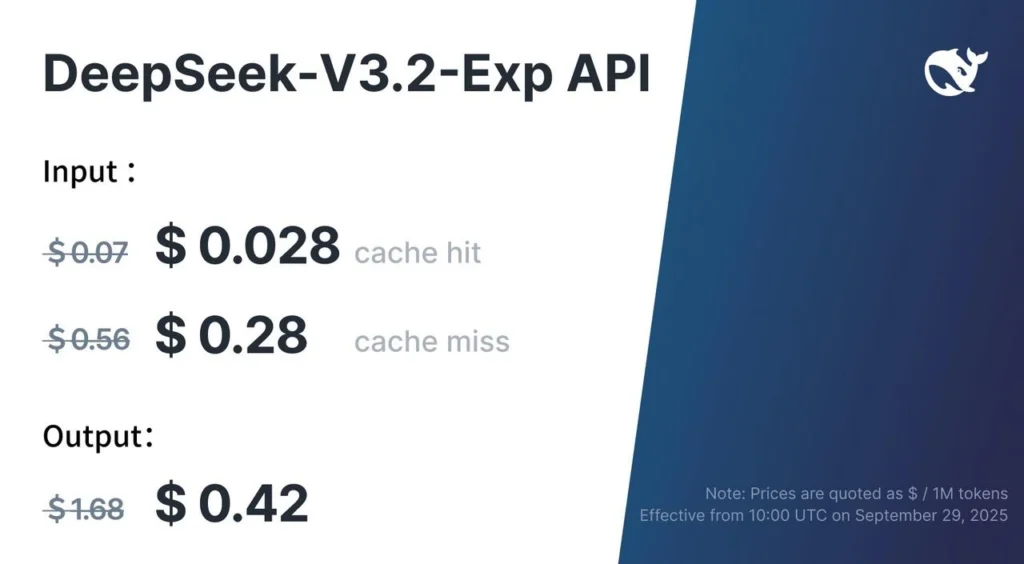

- DeepSeek v3.1 Final: fixes garbled output bugs and boosts agent capabilities.

- DeepSeek v3.2-Exp (open source): introduces a new sparse attention mechanism, dubbed DSA, pushing forward lightweight model performance.

This combination of stability and experimentation underscores open source’s continuing role in advancing AI architecture.

7. New Autonomous Agents: K2 and Meta’s Code World Model

K2 “Moonshot” Agent

From the group “Moonshot” K2 is a new autonomous agent that runs on cloud VMs. It can write code, build presentations, perform data analysis—all autonomously. It hints at agents not just as helpers, but as self-executing digital workers.

8. Meta’s Open Source “Code World Model”

Meta released a world model framework that simulates code execution paths—essentially modeling program behavior without running it. This can be used to build AI “engineers” that debug, plan, and reason about code, potentially reducing runtime dependency.

These developments point toward a future where agent intelligence is increasingly internalized, not just reactive.

Read the technical report:

Download the open weights: https://huggingface.co/facebook/cwm

Download the code: https://github.com/facebookresearch/cwm

9. Operating Systems & UI Intelligence: The Coming Fusion

Google’s Generative OS Prototype

Google is experimenting with a generative operating system, wherein Gemini dynamically generates user interfaces based on task context. No fixed UI — everything adapts.

Anthropic is pursuing a similar vision – Heli: embedding intelligent UI agents into desktops. We may be approaching the dawn of neural operating systems.

10. Google mixboard, Photo Chat & More

- MixBoard: A new AI drawing/painting app from Google, supporting generative artwork.

- Photo Chat / Little Banana Wireless: Google Photos now lets you “chat to edit” your images—one sentence yields beautification, color tweaks, style changes.

11. Facebook’s AI Dating Assistant

Facebook (Meta) launched an AI companion that recommends romantic matches based on data analysis, aligning interests, values, and social behavior.

12. Adobe’s Firefly and Transparent Video

Firefly now supports transparent background video generation, filling a longtime gap in generative media tools.

Sono V5 & AirPods Real-Time Translation

- Sono v5: Upgraded voice models with far more realistic human tone.

- AirPods Translation: Real-time translation arrives—users pay $30/day to upload call audio for training. The server load is reportedly huge.

13. Microsoft’s Content Marketplace

Microsoft aims to launch a content licensing market: if Copilot cites your article, Microsoft will pay you. This could reshape incentives in content creation and the AI-powered web.

Why This Week Matters

- Infrastructure is king: The NVIDIA–OpenAI pact shows compute is the foundation of all AI ambition.

- Model diversification: Microsoft’s inclusion of Claude in Copilot signals a multi-model doctrine.

- Autonomous agents: K2, Meta’s world models, and generative UI hint at a shift from tool to collaborator.

- Domestic innovation: Alibaba’s bold Qwen rollout intensifies global competition.

- Open source momentum: DeepSeek’s updates reflect AI’s shared future.

- Monetization shift: From “free models” to content licensing (Microsoft) and infrastructure loops (Oracle/NVIDIA).

These aren’t isolated events—they’re interconnected signals in the AI industrial cycle.

FAQ: Top Questions This Week

Q: Did NVIDIA really invest $100B in OpenAI?

Yes, under a conditional agreement tied to deploying 10 GW of infrastructure. The first tranche (~$10B) is pegged to the first gigawatt of deployment.

Q: So who actually pays for compute—OpenAI, Oracle, or NVIDIA?

It’s a layered scheme: OpenAI pays for cloud & GPU services (often via Oracle), Oracle procures GPUs from NVIDIA, and NVIDIA invests into OpenAI—but only after infrastructure is deployed.

Q: What does Anthropic’s Claude do inside Microsoft Copilot now?

Users can choose Claude models for reasoning, research, or agents in Copilot Studio. Claude becomes an option alongside GPT.

Q: Is ChatGPT’s new assistant dangerous or invasive?

It raises privacy questions: the agent mines your calendar, email, preferences. Adoption will depend on transparency, opt-in controls, and data safeguards.

Q: Are Alibaba’s Qwen models truly frontier class?

Their roadmap is ambitious. Matching closed-source giants is challenging, but their performance in benchmark contests like math contests is notable.

Q: Why are open source efforts like DeepSeek important now?

They continue to push innovation, reduce reliance on proprietary models, and prototype architecture ideas like sparse attention (DSA).

Q: Will generative operating systems replace traditional UI soon?

Not overnight. But testbeds from Google, Anthropic, and Meta show that UI is becoming more fluid, adaptive, and AI-driven.

Q: Do these moves favor big tech over startups?

Yes and no. Infrastructure plays favor incumbents with capital (NVIDIA, Microsoft, Oracle, Alibaba). But open source trends, model challengers, and developer tools ensure room for innovation at smaller scales.

Final Thoughts

This week’s developments highlight a deepening phase of the AI era. It’s no longer about raw model contests alone—but about infrastructure, ecosystems, autonomy, and monetization models.

- The NVIDIA–OpenAI deal cements compute as the moat.

- Microsoft’s Claude integration diversifies the AI stack.

- Autonomous agents like K2 raise expectations of AI as functionally independent actors.

- Alibaba, DeepSeek, Meta, and others show that competition and innovation are global and multi-front.

- Monetization is shifting: creators, infrastructure providers, and end users are all becoming stakeholders.

Stay tuned: the week ahead will likely show more integration, experimentation, and perhaps surprise pivots.